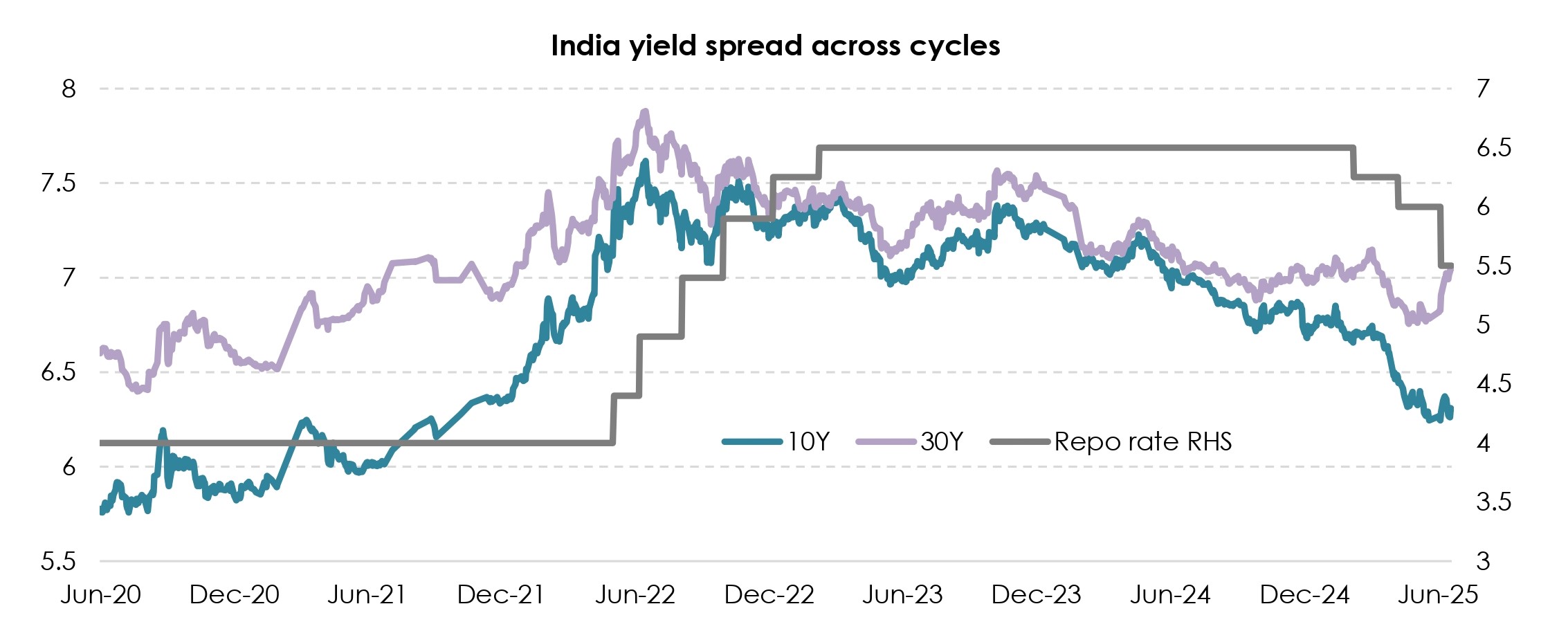

A quick update on widening yield spread with dim prospects of easing, curve set to shift higher with moderating liquidity The spread between 10Y and 30Y sovereign bond yields has been widening, with fading appetite for the duration segment, and we feel there might be some further room for the same. This is after the Reserve Bank of India led Monetary policy committee surprisingly changed the policy stance to neutral from accommodative along with a frontloaded 50 bps rate cut. This has diminished hopes around further easing, making bond market participants defensive for the longer end of the curve. During the past extended pause, the spread between 10Y and 30Y bond has widened to as much as 100 bps, and nearly 200 bps between the 2Y and 30Y papers (though this was also driven by surfeit liquidity surplus during the pandemic). Following the Jun policy meeting, the yield curve shifted from bull steepening to bear steepening, though the curve has now begun to shift higher on possibility of RBI moderating liquidity surplus through fine tuning operations