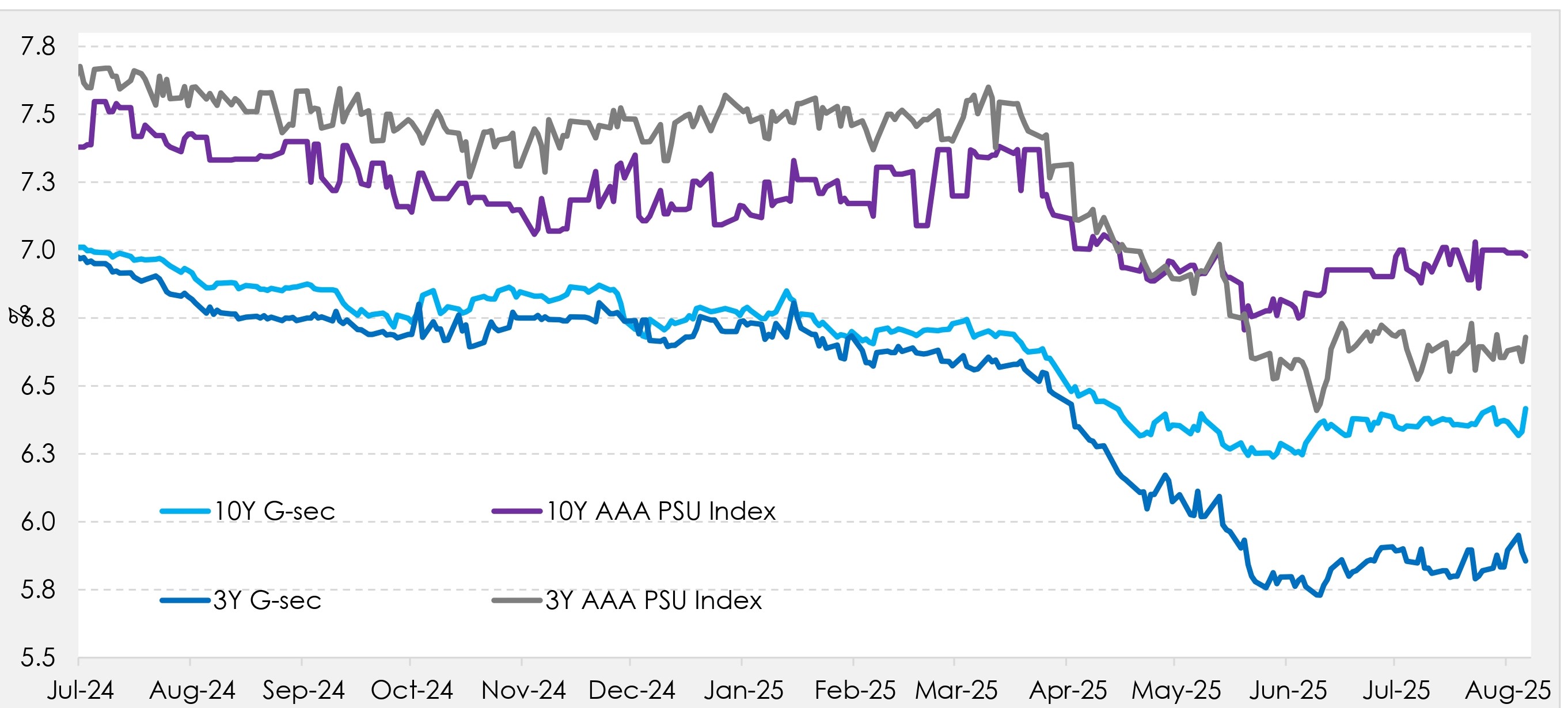

In this edition of Bond Compass, we highlight the key themes for Jul/early Aug : • India G-Sec yields closed 5-6 bps higher in July, driven by lingering uncertainty around potential US tariffs on Indian exports, continued weakness in Indian rupee and participants anticipating a status quo on rate cut by the RBI MPC in early August. • The INR fell over 2% against the USD in July 2025, its steepest monthly drop since 2022, amid foreign outflows and renewed trade tensions after U.S. President Trump announced a 25% tariff, alongside an unspecified penalty on Indian exports from August 1. • The RBI actively managed liquidity through both injections and absorptions in July, aiming to keep overnight rates near the policy repo rate. System liquidity remained in surplus, averaging ~ INR 3 trillion