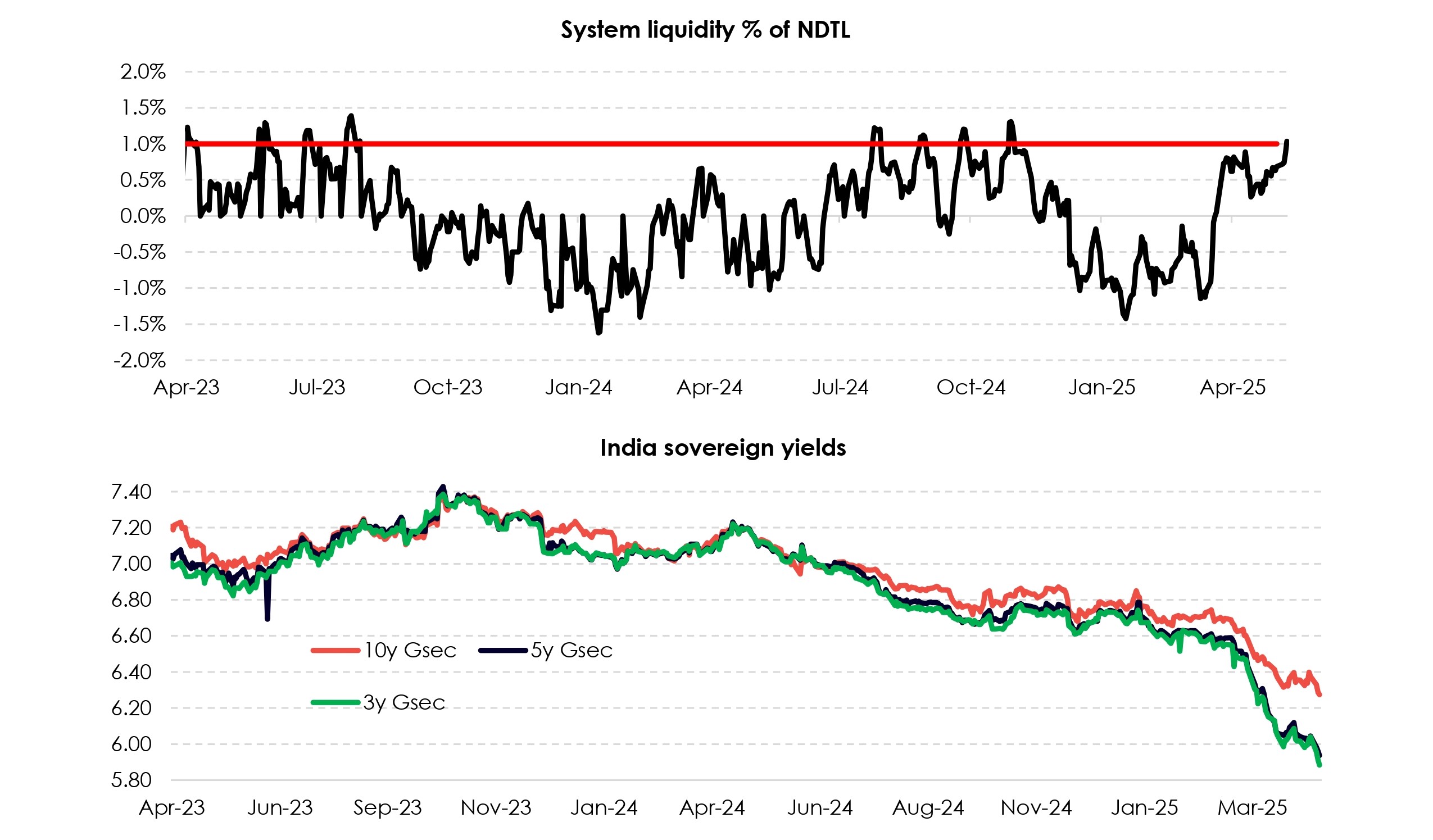

IN system liquidity rises above 1% NDTL stated preference, rates largely unfazed by global benchmarks India system liquidity conditions improved further in May on account of RBI’s continued injection of durable liquidity via OMO purchase auctions. As on 17th May, system liquidity crossed 1% of NDTL (det demand and time liabilities). In the April RBI MPC meeting, Governor Malhotra indicated a preference of keeping liquidity around 1% NDTL. While the frictional monthly GST outflows may withdraw liquidity around 19-21st May, this will be offset by G-sec redemption of INR 553.67bn on 25th May. Conditions will be further augmented by month-end GOI spending (salary disbursals). Continued injection of durable liquidity was said to be on account of RBI taking delivery of maturing net forward shorts instead of rolling it over (this takes INR liquidity out of the system, so further OMOs were conducted to offset the impact of maturing forward shorts). India sovereign yield curve has continued to bull steepen as seen below – this is on the back of ample liquidity conditions. The next major trigger for markets will be the announcement of RBI surplus transfer to the GOI for FY25 (likely this Friday). Market estimates for dividend lies between INR 2.5-3trillion, with few estimates even suggest a reading above INR 3tn given heavy profits realized from gold prices and FX operations.