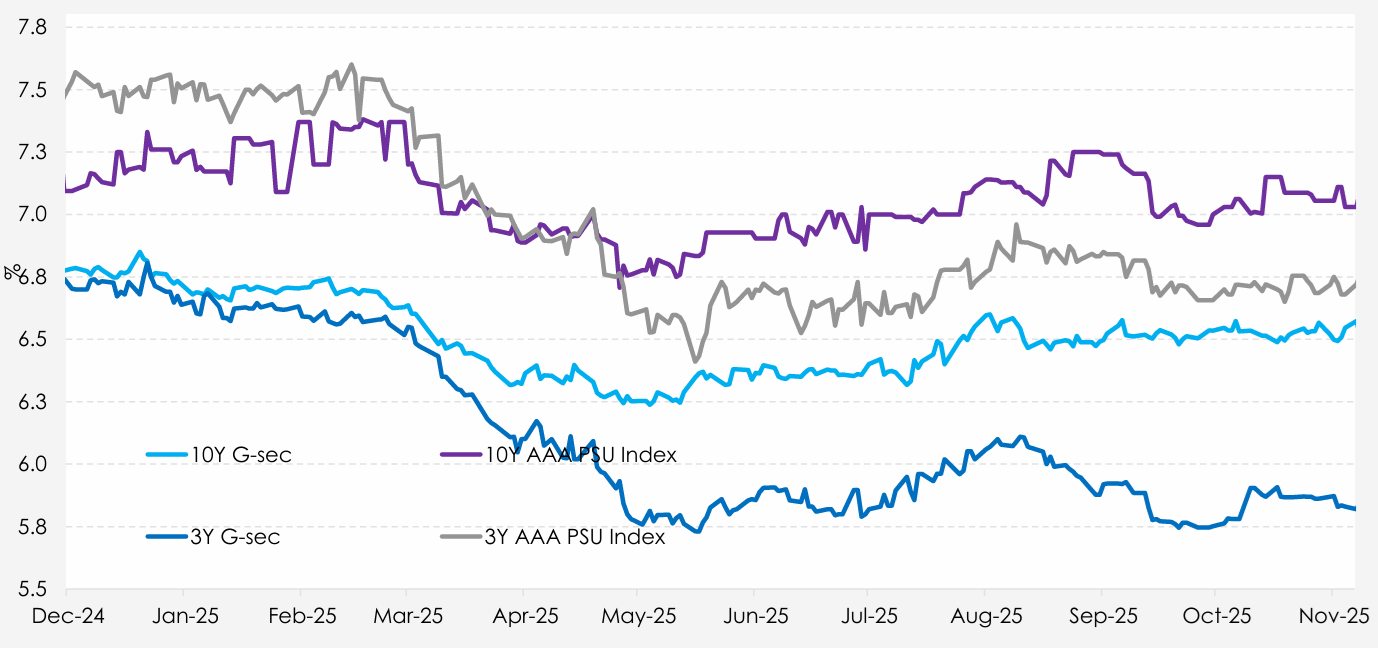

In this edition of Bond Compass, we highlight the key themes for Nov : • India G-Sec yields see-sawed within the range of 6.47-6.58%, closing 2 bp higher at 6.55% in November, driven by various factors: record low CPI inflation data, stronger GDP data, RBI intervention in G Sec market, sharp depreciation in INR, reopening of the US shutdown, likelihood that India's fully accessible route gilts would be included in the Bloomberg Aggregate Index and surplus banking system liquidity. • India’s headline inflation came at 0.25% in October from 1.44% in September on the back of the impact of GST rate cut on prices along with subdued food inflation and favourable base effect. Also, the core CPI slightly moderated to 4.4% in October from 4.5% a month ago. • Meanwhile, the Q2FY26 GDP print accelerated to 8.2% in the second quarter FY26, compared with 5.6% in Q2 FY25 and 7.8% in Q1 FY26 on the back of rebound in manufacturing sector and momentum in services sector. This led to hardening of yield taking the 10Y point to 6.58% which diminished the hopes of RBI MPC rate cut at the December policy. • To limit the surge in 10Y yield and support the bond market RBI actively intervened through secondary OMO purchase. • The banking system liquidity stayed in surplus after the last two tranches of CRR cut came into effect, leading to VRRR auction by RBI throughout the month. • Indian rupee depreciated to record low of 90.42/$ on the back of likely FII outflows from local stocks and delay in US-India trade deal. • With RBI cutting repo rate by 25bps at the December policy, henceforth the focus will be on the upcoming local data, hopes of an incremental trade deal with India-US before the end of Dec 2025, potential inflows related to inclusion of India in Bloomberg Global Aggregate Index along with FOMC December monetary policy outcome and its rate guidance for 2026. We expect FOMC to cut rate by 25bps signalling a dovish stance.