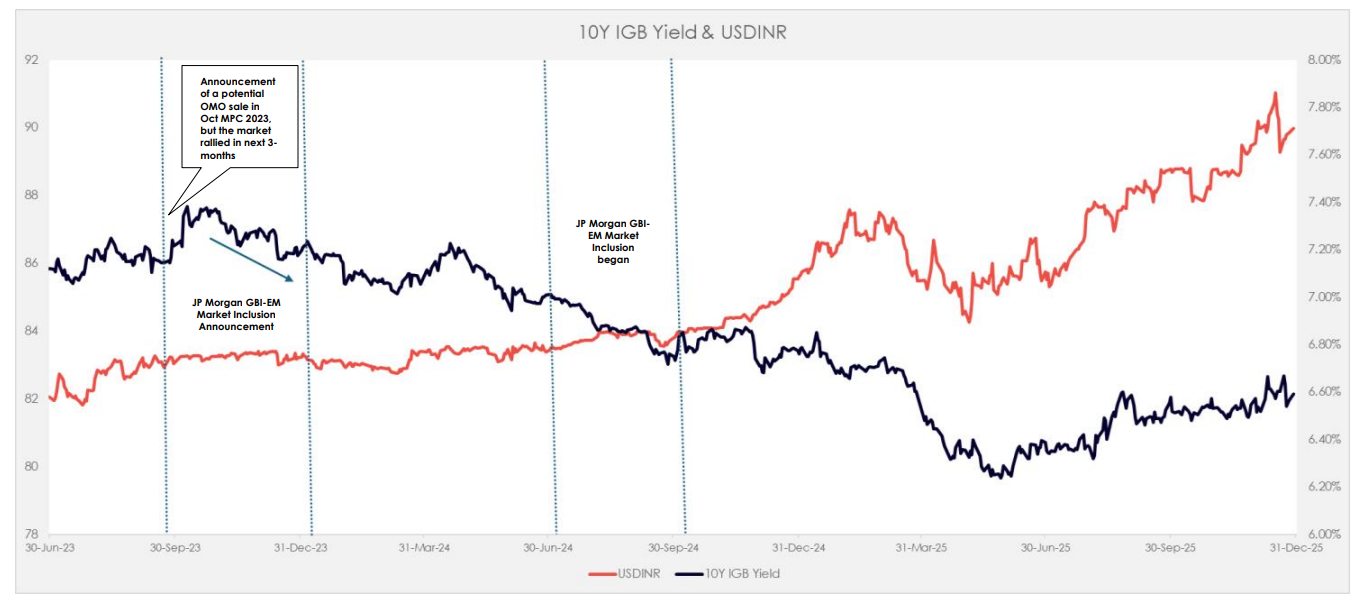

As the new year begins, the 10-year IGB ended 2025 at 6.59%, following a month of heightened yield volatility after the RBI’s December policy announcement. While the RBI cut the repo rate by 25 bps and unveiled a series of liquidity measures including INR 1 trln of OMOs and a 3-year USD 5 bln USD-INR buy-sell swap, the subsequent market reaction proved decisive. The INR depreciated to record lows, breaching 91.08/$, hedging costs rose sharply, and 10-year IGB yields hardened to around 6.68%. In response, the RBI announced additional liquidity support through INR 2 trln of OMOs and a USD 10 bln USD-INR buy-sell swap to contain upward pressure on yields. Since then, 10-year yields have moderated; however, with INR 1.5 trln of OMOs already executed and the first tranche of the buy-sell swap completed, market participants are now seeking incremental directional cues