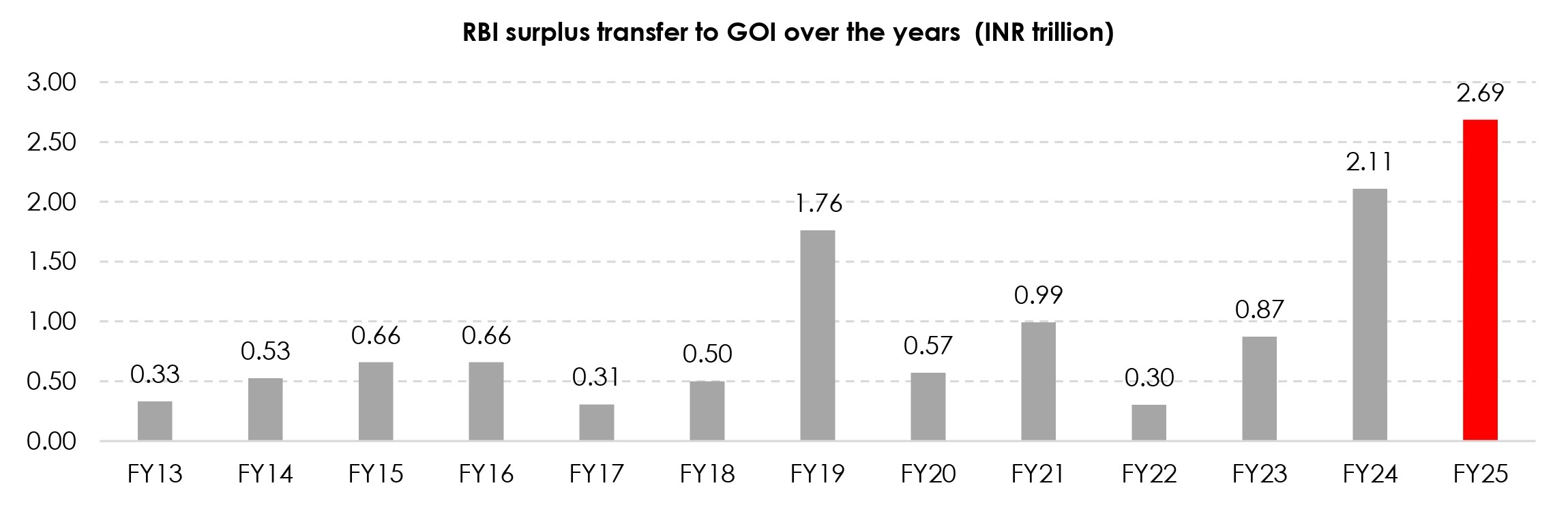

RBI announces a record surplus transfer to GOI for FY25, though numbers modestly miss market expectations The Reserve Bank of India announced a surplus transfer of INR 2.69 trillion for FY25, about 27% higher than the previous year. The central bank increased the contingent risk buffer (CRB) to 7.5% from 6.5% for FY24 in resonance with the revised economic capital framework, and taking into consideration macroeconomic assessment. A higher surplus transfer was said to be on account of gains realised from RBI’s FX interventions along with investments into domestic and foreign assets. However, the reading modestly missed market expectations of around INR 3-3.5 trillion likely given a rise in the risk buffer from last year. While bond markets had positioned for a higher surplus transfer for FY25, we may witness a knee-jerk reaction this week. The curve continued to bull steepen, with the near end of the curve outperforming on optimism around liquidity conditions remaining ample. We expect the central bank to maintain liquidity around 1% NDTL as indicated in the April MPC meeting. A more conservative approach (given lower than expected surplus transfer) to this at this point means that the central bank remains cautiously optimistic around how the currency pans out in the near future, while also being mindful of inflationary impact of excess liquidity (if it persists). However, this development may not alter market expectations on the policy rates front as the central bank has disassociated the accommodative policy stance with the liquidity management approach.