In this edition of Bond Compass, we highlight the key themes for Nov :

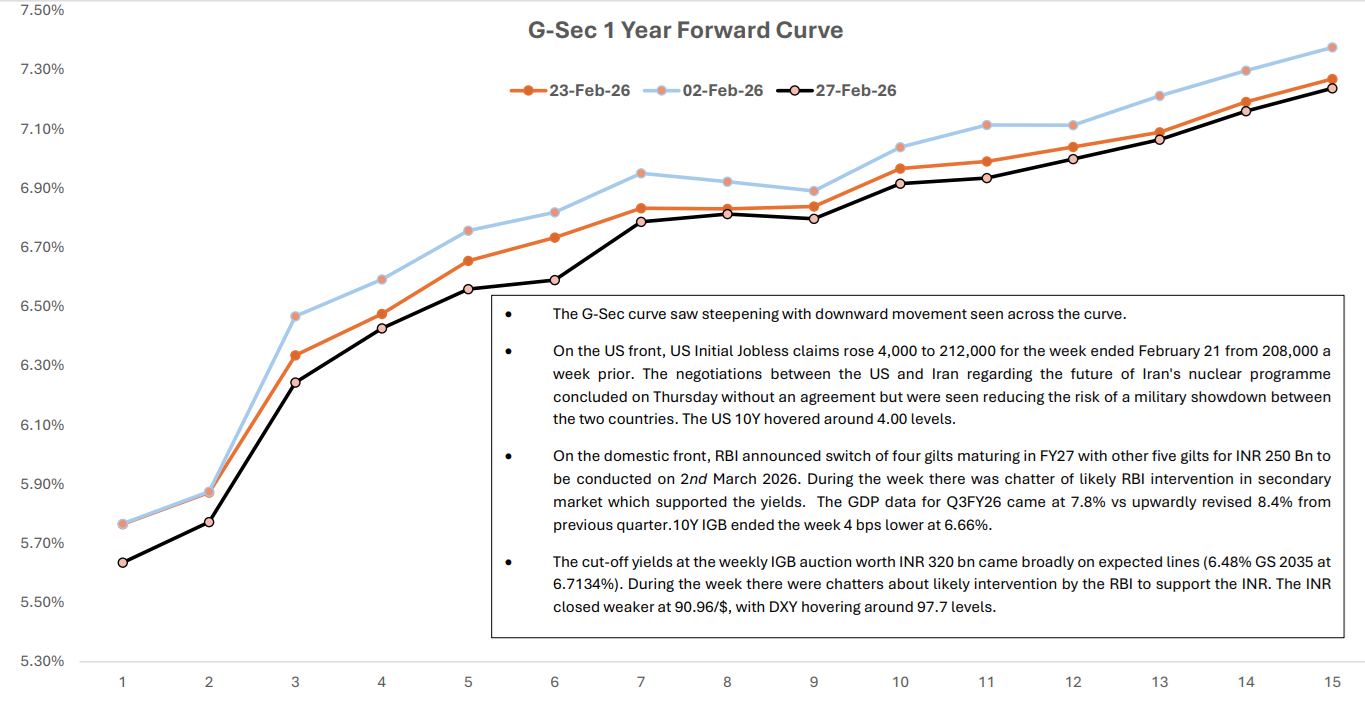

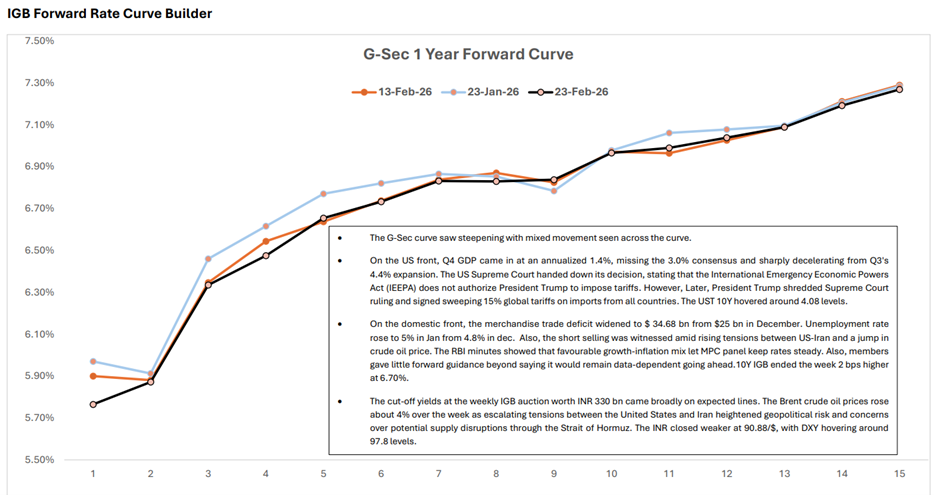

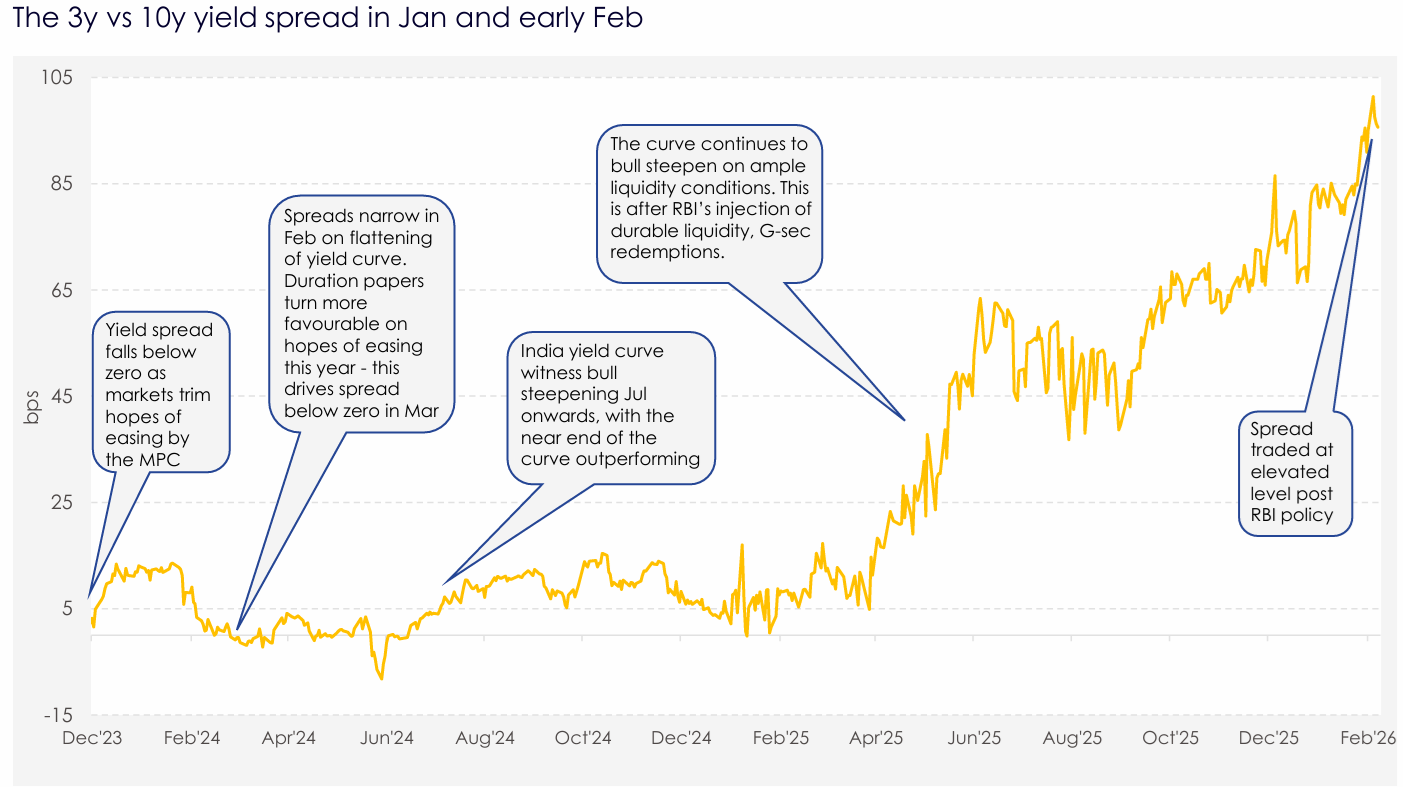

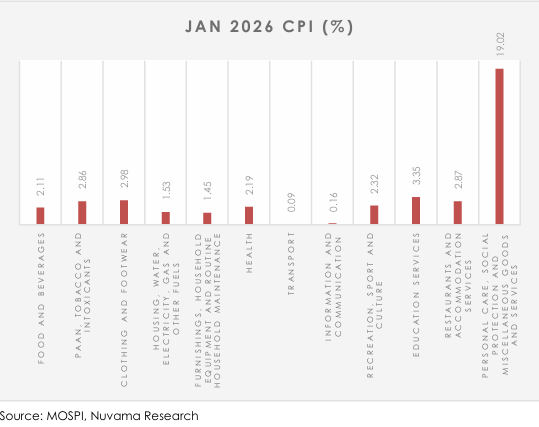

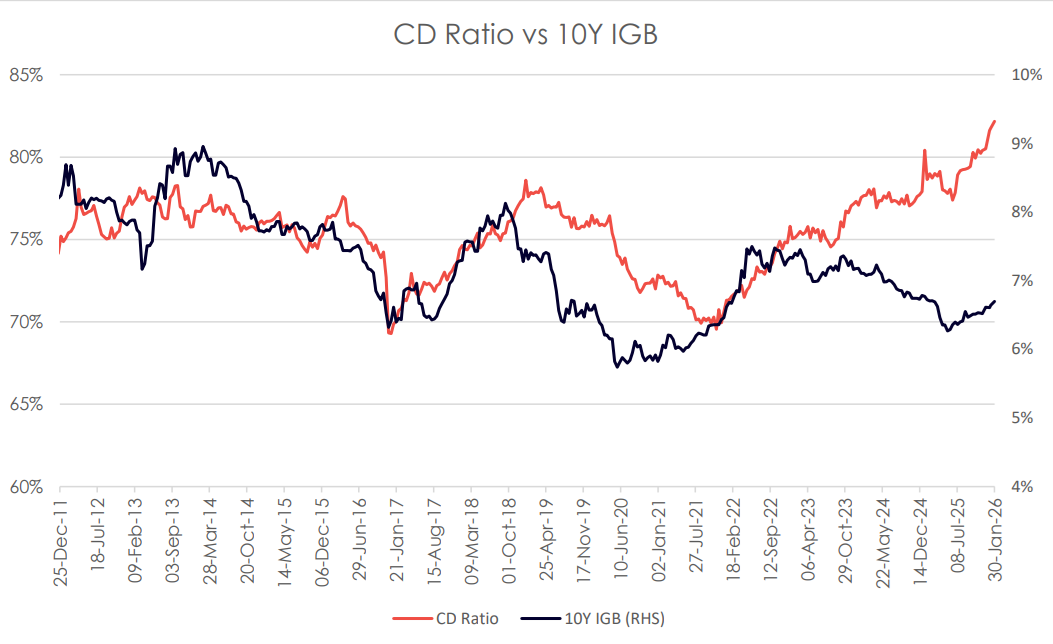

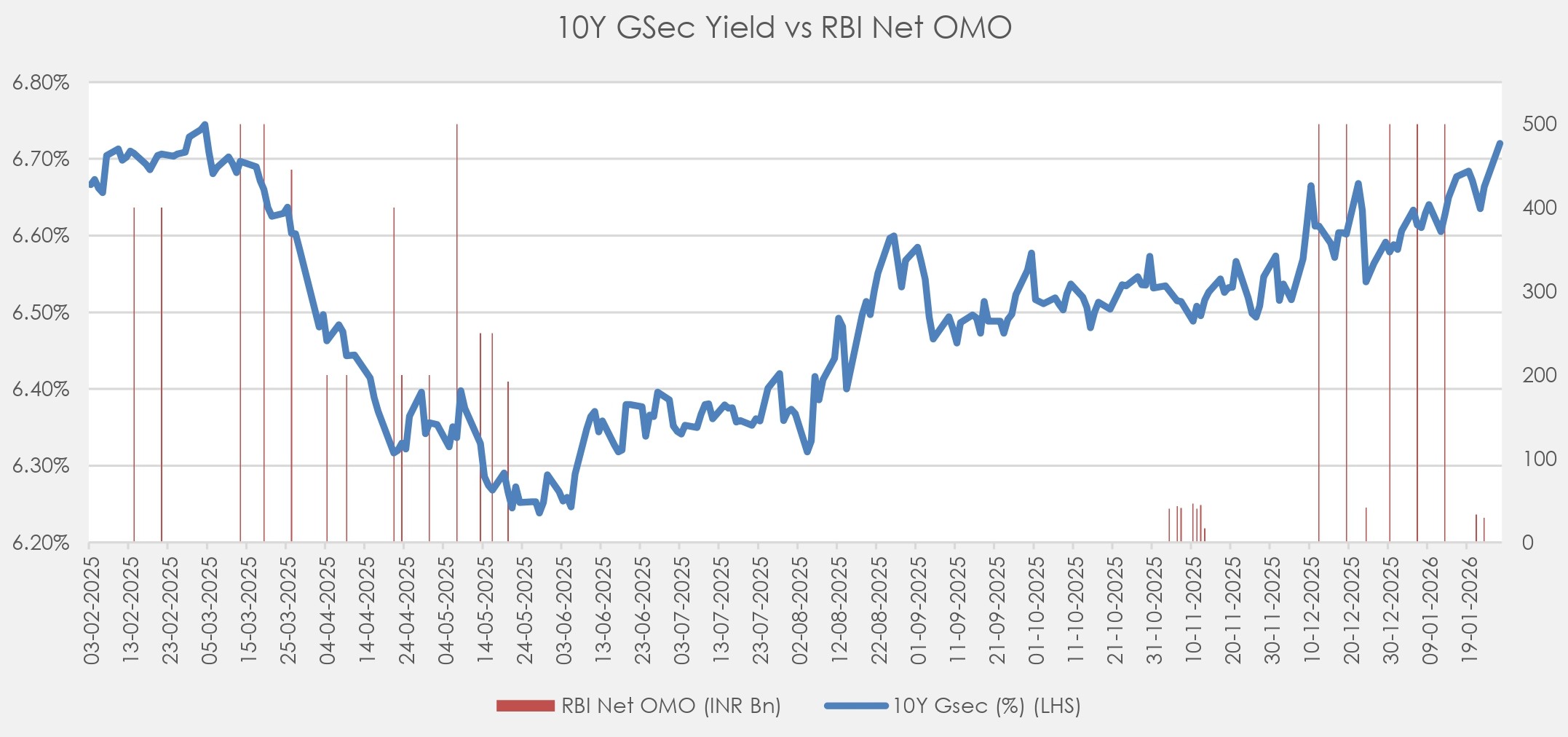

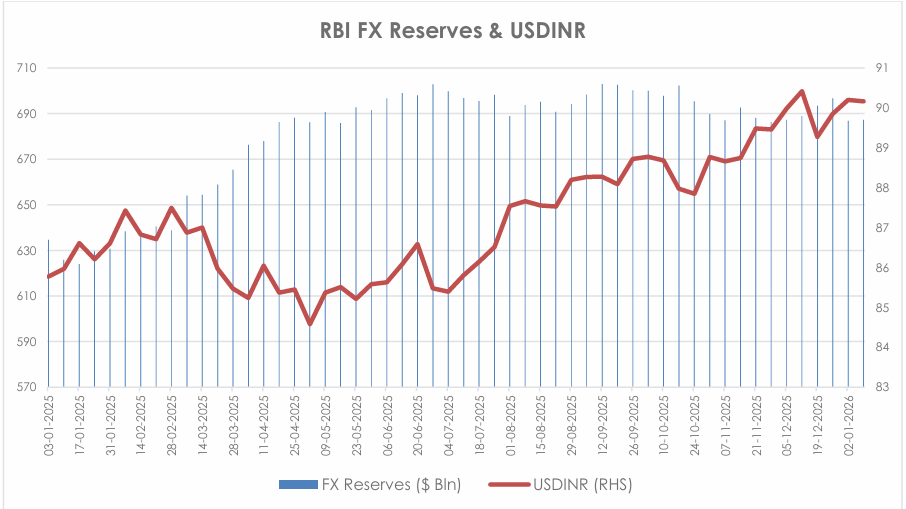

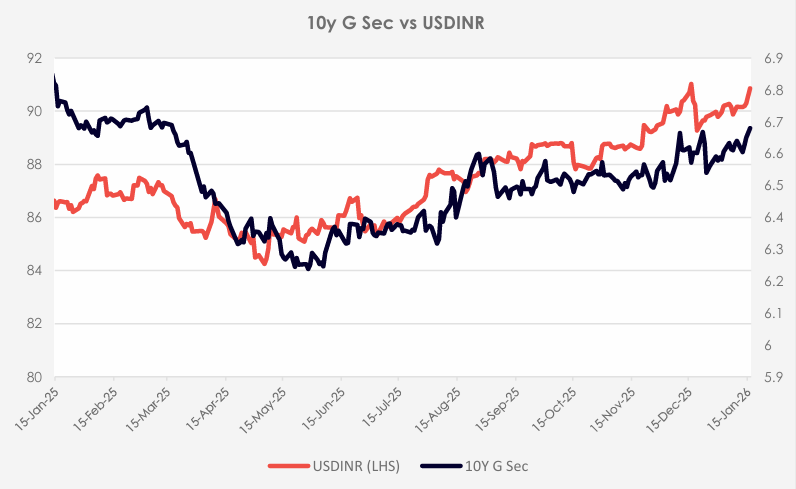

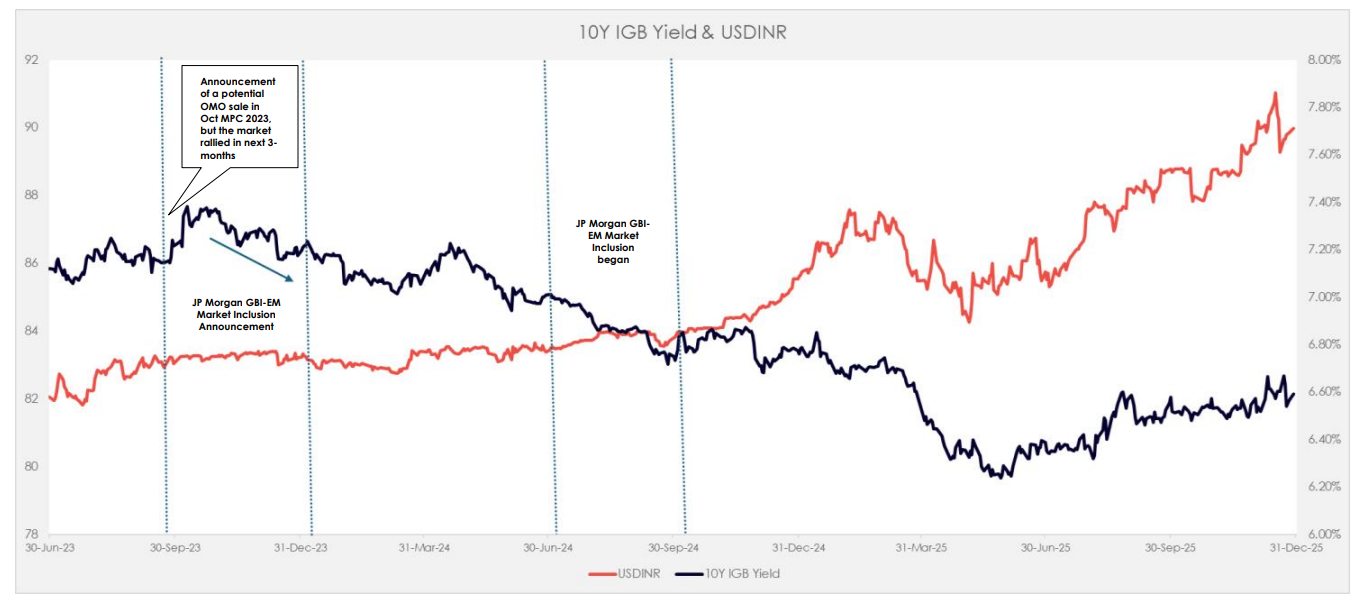

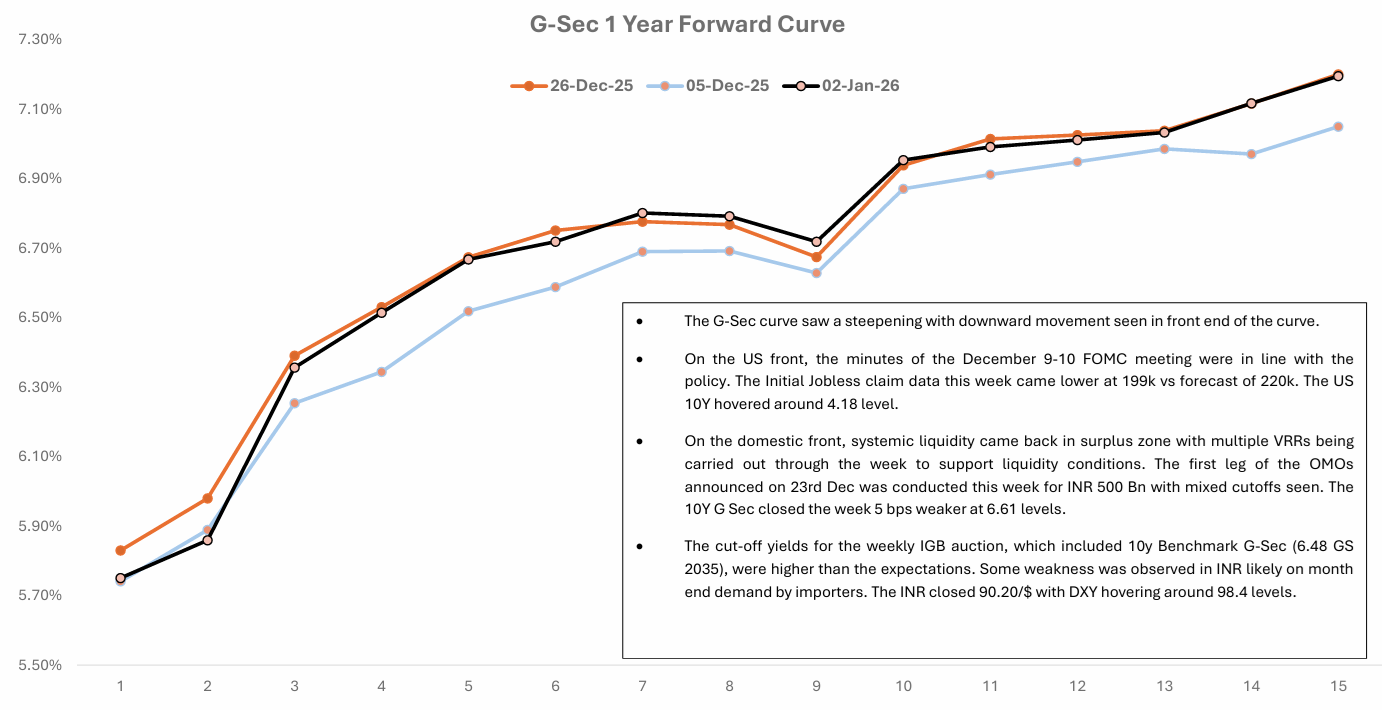

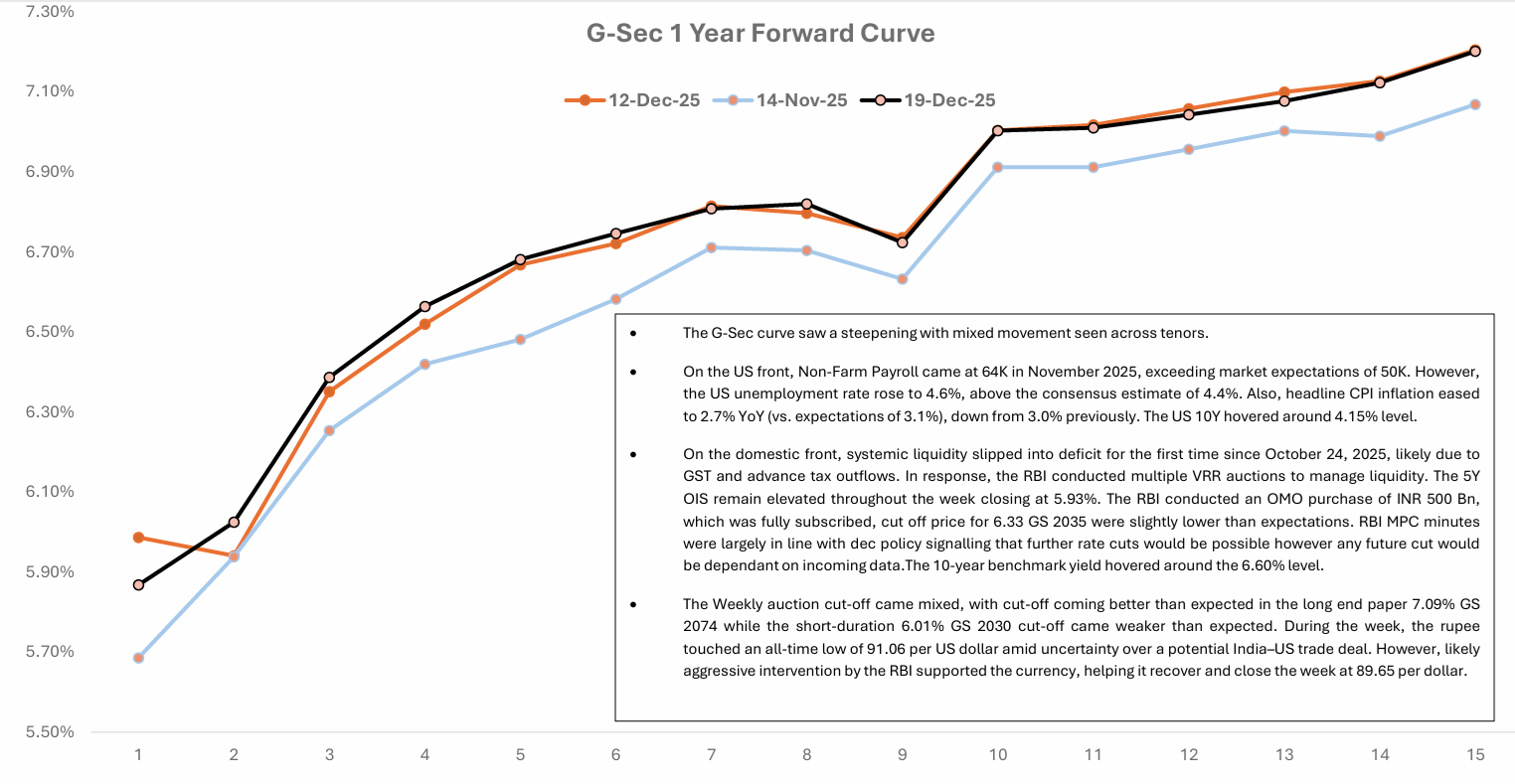

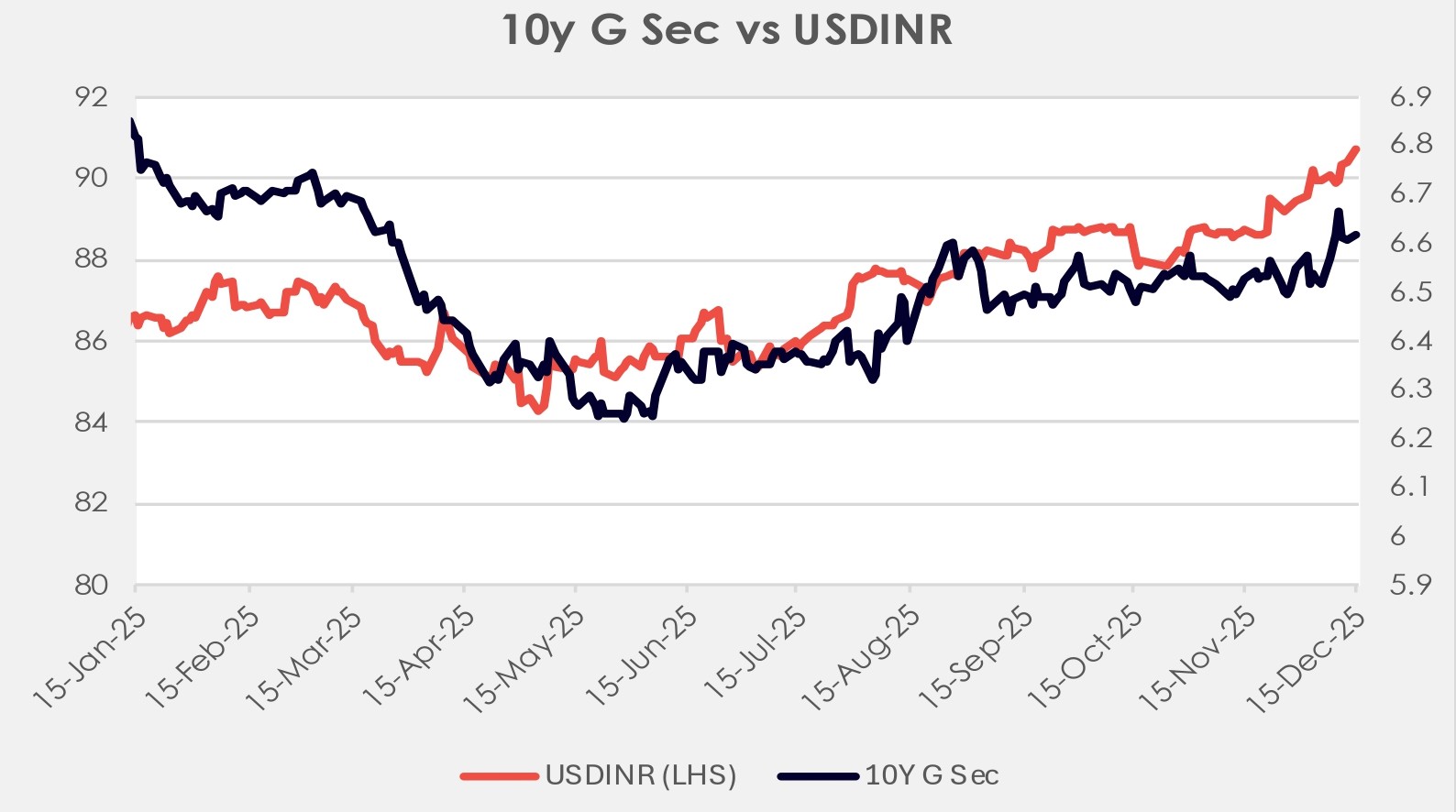

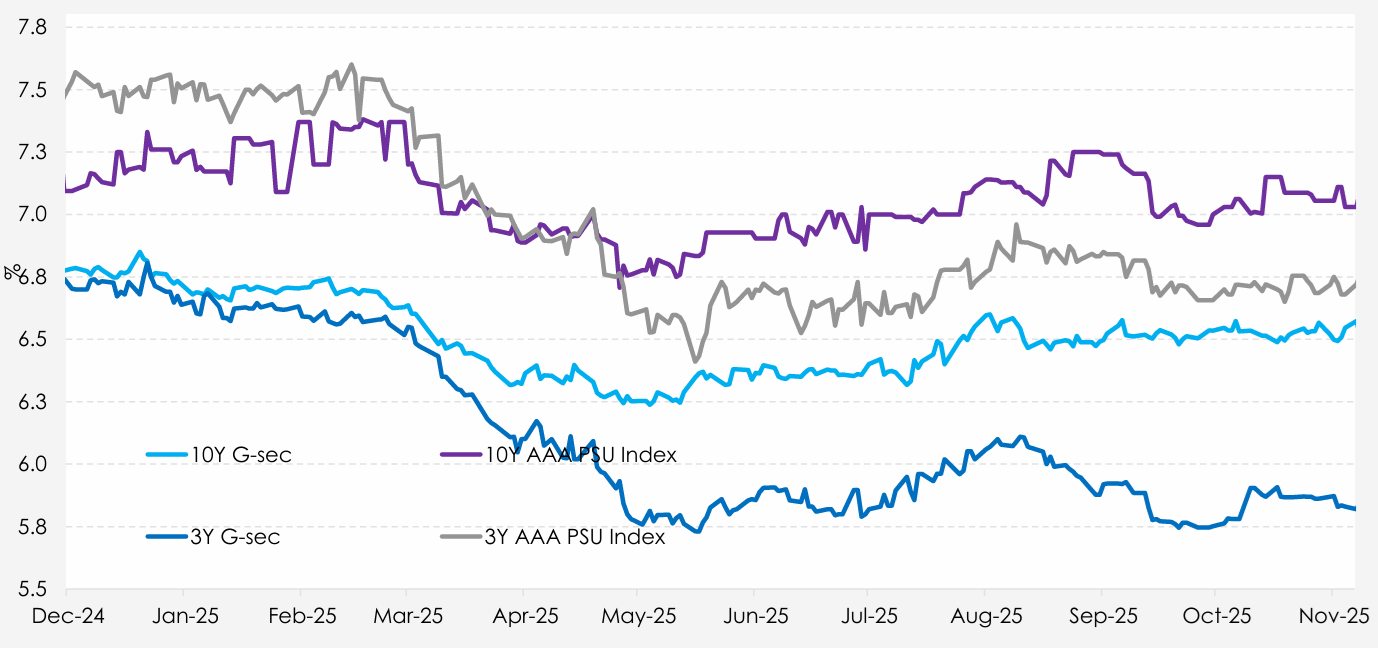

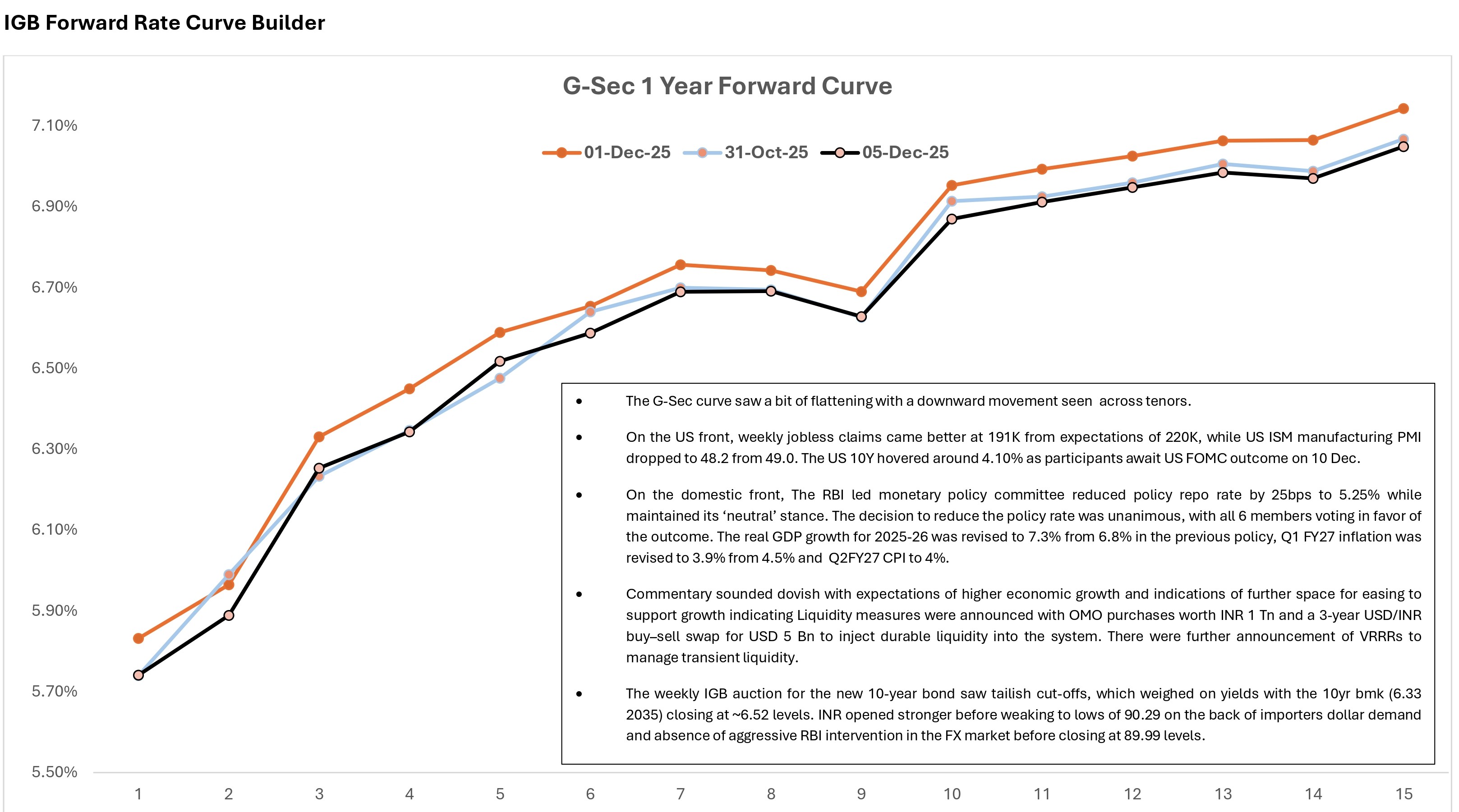

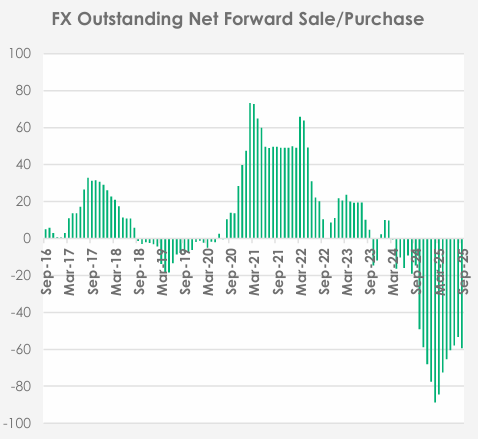

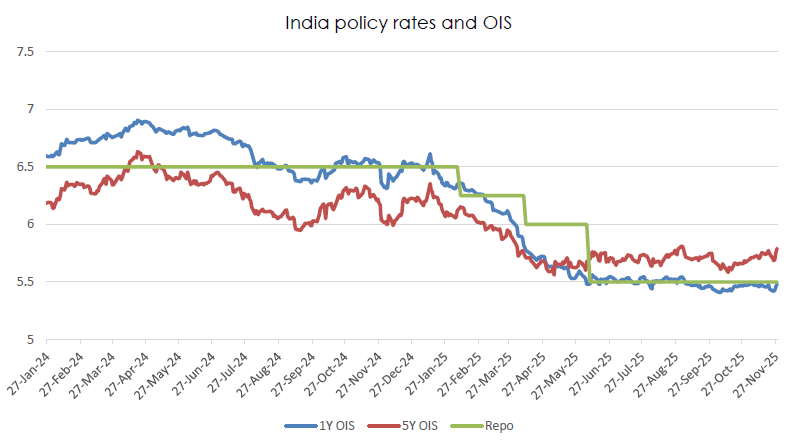

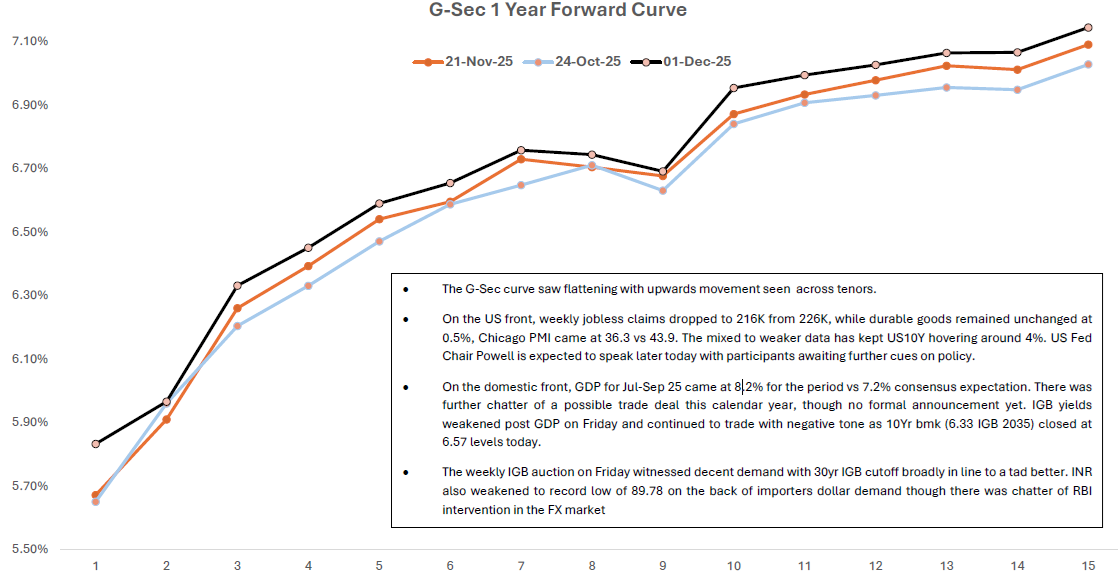

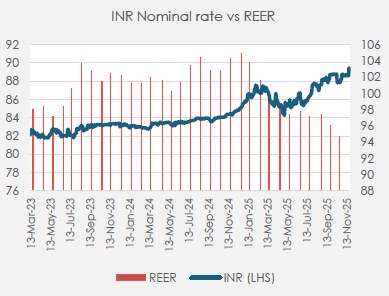

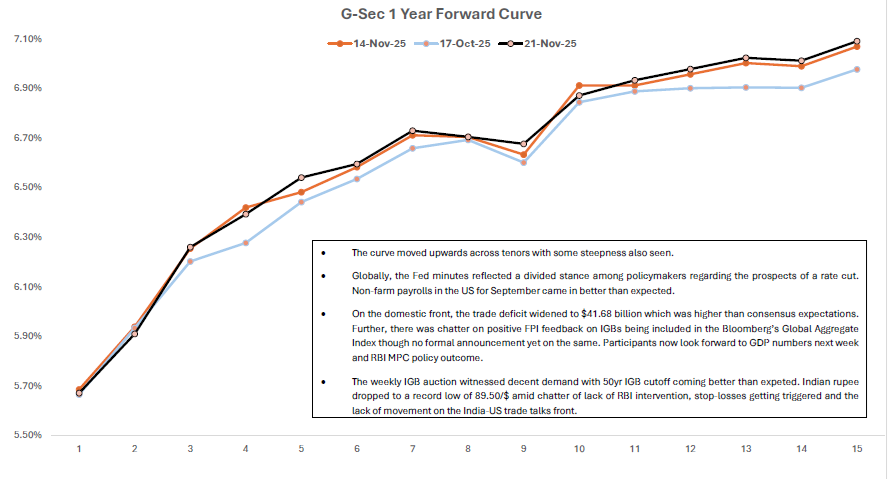

• India G-Sec yields see-sawed within the range of 6.47-6.58%, closing 2 bp higher at 6.55% in November, driven by various factors: record low CPI inflation data, stronger GDP data, RBI intervention in G Sec market, sharp dep...